Teaching teens about money and the consequences of their financial decisions can be challenging.

Thankfully, there are ways to build financial literacy for teens that don’t involve lecturing!

This article contains affiliate links to things that you might like.

I was compensated for my time to write this post. All opinions are my own.

Personal Finance for Teens

Now that all three of my children have reached the age where money and financial decisions are something very real in their lives, I’ve realized that teaching them to become financial literate is more important than ever.

While I learned some things about money as a teen, I’ll be honest that I didn’t really know a lot about it when I graduated high school or even college.

Managing money was big and scary and complex.

And sadly, that’s a belief that has taken a lot to get rid of and still infiltrates my beliefs to this day.

But for my kids?

I want it to be different!

So, here are five ways to build financial literacy in teens that aren’t overwhelming for them or for you!

3 Ways to Teach Financial Literacy to Teens

Open a Checking and Savings Account

When my kids were little, we used “The Mommy Bank,” where they’d earn money, and then I’d store it for them.

I was essentially their bank.

When they got old enough to get their own bank accounts, I took them to open up a checking and a savings account where I was a co-signer.

We discussed what each is for and that the money in savings doesn’t get touched unless there’s an emergency or being used to pay for something they have been specifically saving for (i.e., a laptop, a car, etc.).

This gives them the opportunity to manage their money while still giving me access to their accounts if needed.

Use a Financial Literacy Program

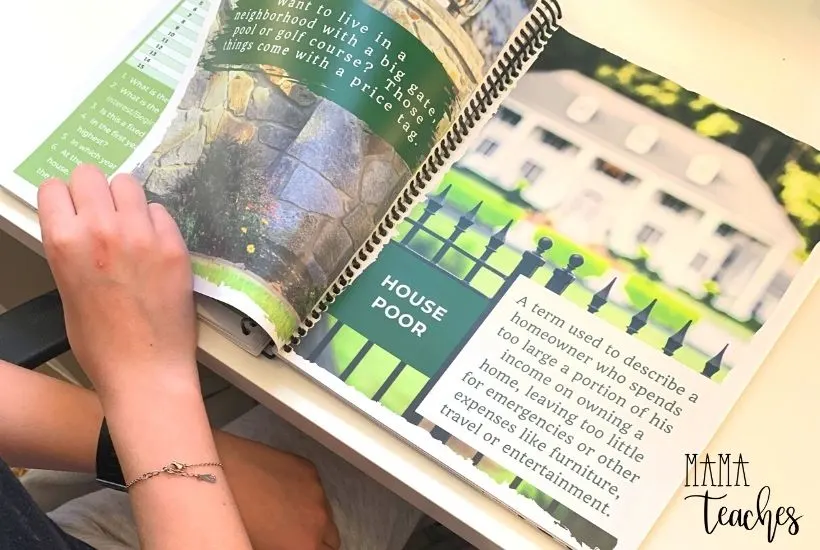

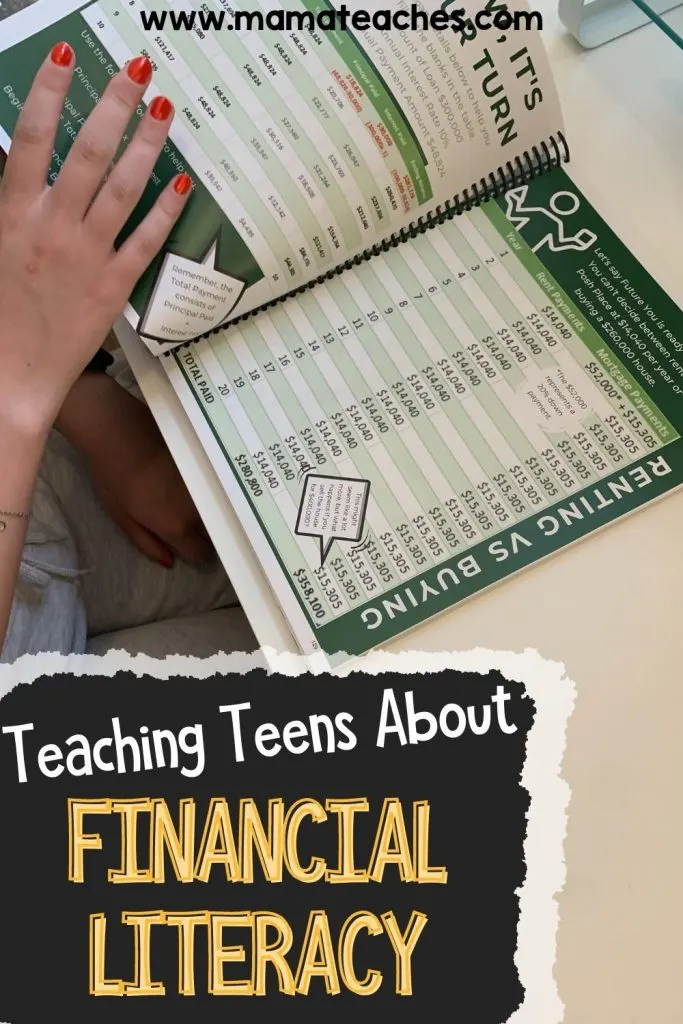

We like the Beyond Personal Finance financial literacy curriculum.

It’s different from many financial literacy programs because it gives teens the power to make decisions and then see the consequences.

How does that work?

Beyond Personal Finance gives teens options instead of lecturing them or having tons of heavy reading to do (which makes finances seem even more overwhelming!).

It starts with deciding what type of career they want to pursue after high school.

That career path then leads to other decisions like college costs, apartment rent, buying a car, getting married, having kids, etc.

Teens quickly see how one financial decision can impact all other aspects of their lives.

I love it because I don’t have to be the one who lectures them that maybe going to college as an Art Major vs. a Finance Major won’t give them the luxurious lifestyle they’re envisioning.

They can quickly see how the starting salaries of both careers compare and then how that will impact where they live, the luxuries they can afford, and the lifestyle they are able to build.

Don’t get me wrong, I want my kids to pursue whatever field they are interested in and whatever brings them joy.

At the end of the day, their happiness and health matter far more than a paycheck.

But as we all know, money affords opportunities, and if they want those opportunities, they need to understand that their choices will either get them there faster or slower than they are anticipating.

Beyond Personal Finance puts them in the driver’s seat and lets them see their choices played out in a financial way.

We have used the Self Paced Financial Curriculum for Individuals, but there is also a Self Paced Financial Curriculum for a Group if you’re working with a class in school or as part of a homeschool group.

Both are the same in that they offer the same pre-recorded videos and materials.

The Group class is especially powerful because the teens get to see how everyone’s choices lead to different outcomes.

It makes them more aware of their own decisions and helps them tweak their expectations and financial steps.

It’s really a great low-prep financial literacy curriculum that empowers teens to make smart choices for their futures.

Be Open About Money

Money is one of those subjects in the American culture that is still almost taboo to talk about in-depth.

Sure, people talk about money, but they don’t really delve into discussions about finances.

One way to break the cycle of silence around finances and help teens become more financial literate is to actually talk about it.

Talk about salaries and bills.

Explain the reasons behind financial decisions and have those seemingly tough conversations.

It’s okay to talk about decisions you wish you hadn’t made as much as it’s okay to talk about what decisions have been instrumental in helping your family get the things they have.

Our children deserve to know that money is not evil, it’s not complicated, and it’s not something to worry about.

It’s a means to an end and making smart decisions over time can give them the lifestyle they want as they grow up.

Financial Literacy

How do you talk with your teens about money?

What are some of your favorite financial literacy resources?

Share with us below!