Start off on the right financial foot by teaching kids about money!

Here’s how!

This article contains affiliate links to things that you might like.

Financial Literacy for Kids

We all agree money is important.

No matter your opinion on it’s worth in relation to happiness, one of the most valuable skills in life is knowing how to manage your money properly.

By providing a solid understanding of fiscal responsibility, your child will be able to navigate the world with a better idea of how to save, how to profit, and how to thrive!

These tips for teaching kids about money can be used for any age group but might vary in execution depending on how old your kids are.

The good news?

It’s never too late to start!

Note: Even if you have struggled with your relationship to money in the past, you can create a better future for your kids. One of the most powerful lessons may be showing them that their relationship to money can change over time. You can do this!

Teaching Kids About Money starts with you

Start Early

It’s never a bad idea to start teaching your children about the value of money.

Doing this from a young age will give them more time to work out any bad spending behaviors, as well as, begin to save for their futures.

If you haven’t started early, don’t panic!

It’s not too late to start!

Even teenagers can get the hang of managing money – especially once they get their first jobs!

Real Practice

Give kids a chance to practice in a real-life setting.

Letting them play a role when grocery shopping is a great start.

Begin by giving them a little bit of money to budget and buy their snacks with.

Then, have them write down what they bought plus how much each item was.

You can also let them look through catalogs for the best coupons or deals (which can be made into a game for younger children.) This will give them real experience with how quickly money can go and where it goes.

As they practice this, it will teach them to be mindful of what they choose to get, what they really need, and how to find bargains.

You could also have them practice at a restaurant!

Use the free Real Life Math: Rainbow Restaurant to help!

Make it a Game

Make teaching kids about money a game – with a game!

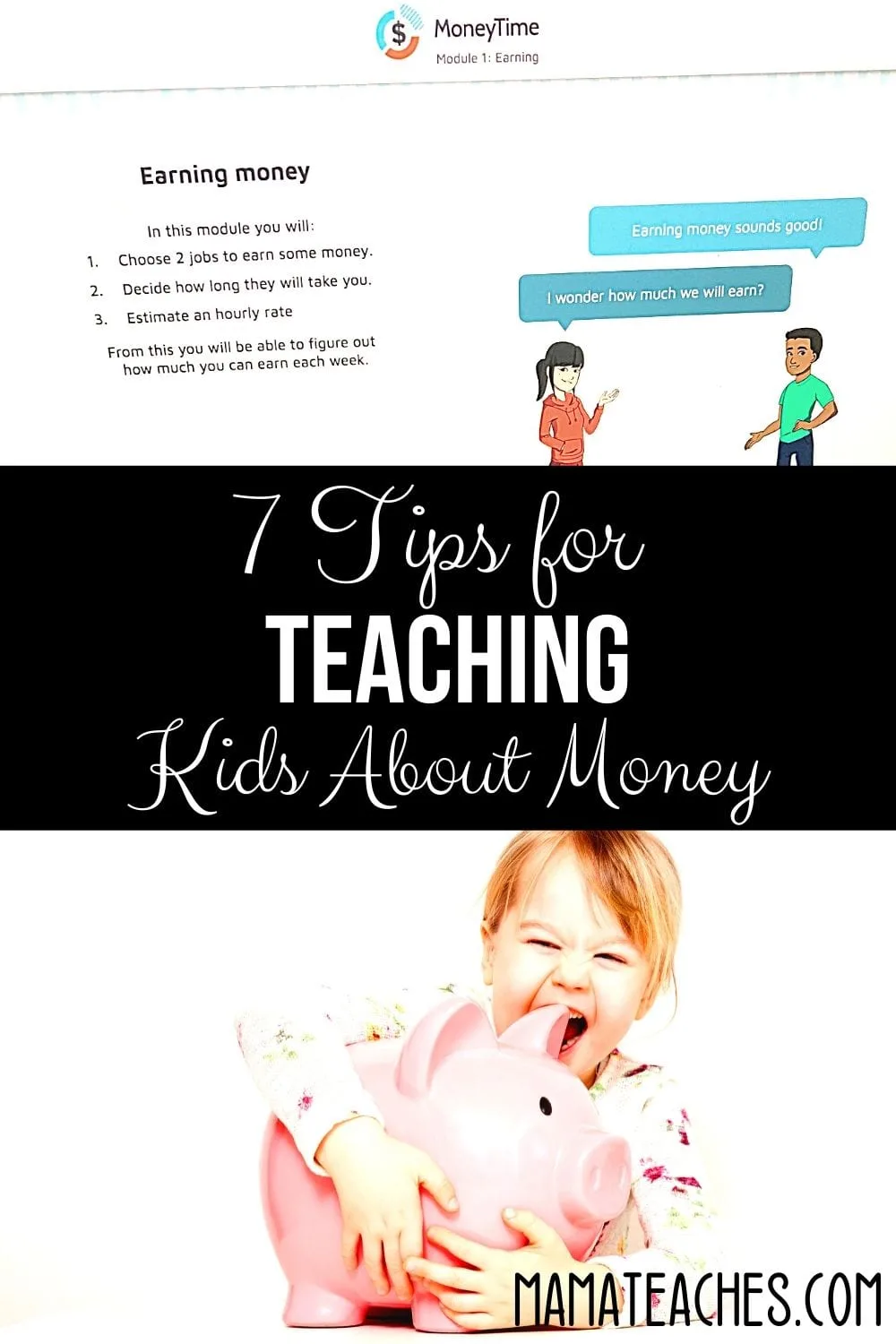

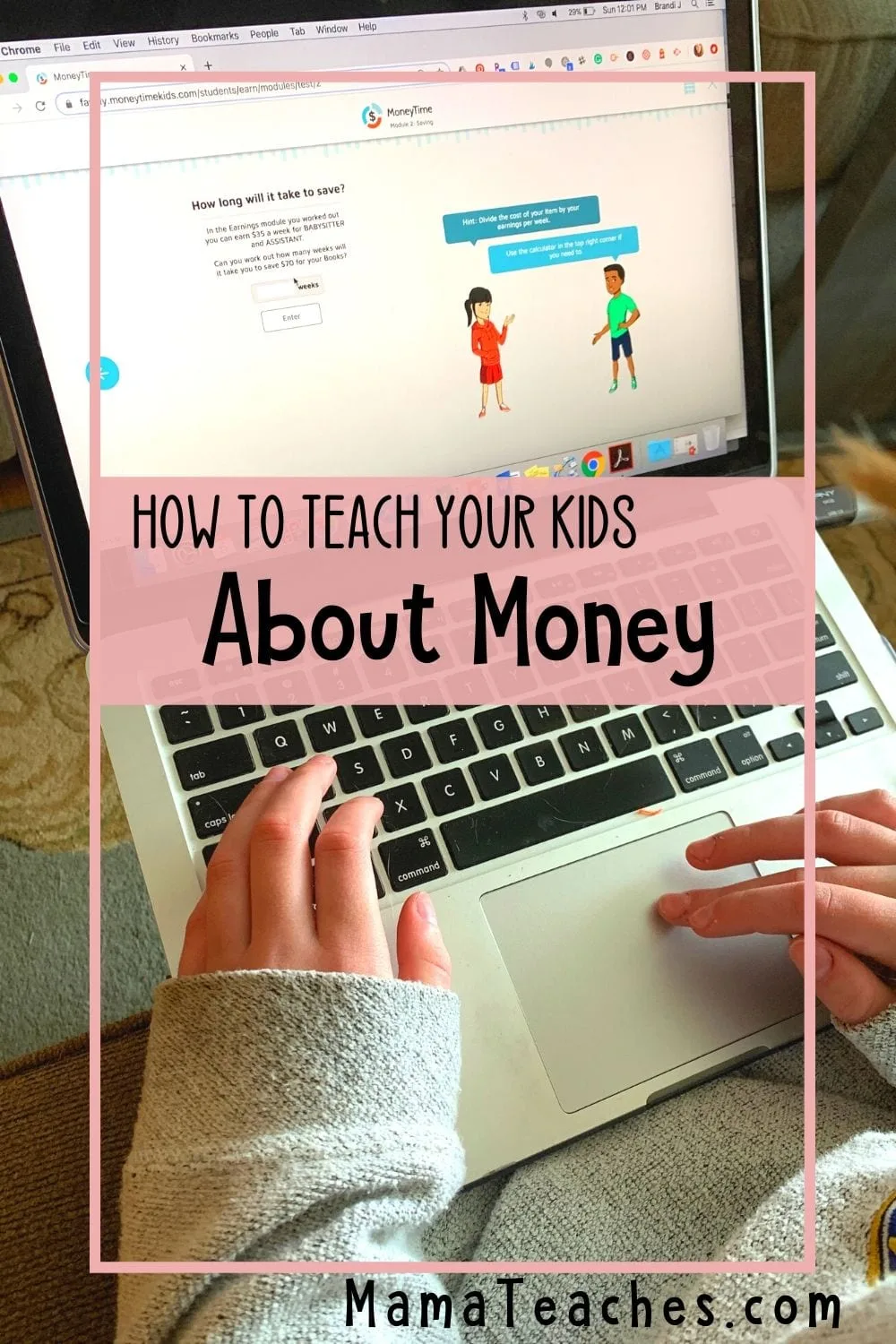

We were so excited to partner with MoneyTime to try out the MoneyTime Financial Literacy Program for kids to help teach our teens about financial literacy.

It’s an online game that teaches kids about everything from interest to hourly wages to investing.

As someone who has certain hangups about money and who, admittedly, is not as financially savvy as I should be, it was a huge relief to have a reliable, easy to understand resource for my kids.

Honestly, I’ve been learning as much about financial literacy as they have!

Students earn money by going through each module that they can then spend on their avatars or by donating to charity.

I love the charity donation option!

It’s a great way to teach them about using their money to give back and help create a better life for those around them.

What do the kids think of it?

They love the program and look forward to using it.

We’ve incorporated it into our math curriculum time, but you could easily use it as a supplemental course or even an elective for high school.

Financial literacy for teens is a life lesson they need!

I’m learning a lot about the basics of financial literacy that I didn’t know before.

It’s been really interesting.

G, 16

I didn’t know what interest was or how it worked, so that’s been neat to learn about.

I also like being able to spend, save, and invest.

It’s fun to do it as a game and I’m saving my own money now too.

S, 12

There is a cost for the MoneyTime program, but they offer a 60 Day Money Back Guarantee so that you can try it.

If you don’t like it, they refund you in full.

There are also three different family subscription options – 1 child, 2 children, and 3-5 children (because you’ll want each child to have their own account).

If you have more than 5 kiddos who will be using it, they said to contact them at [email protected] because they’re happy to work with you!

You can also use the discount code HSCHOOL20 to get 25% off your subscription and enter the giveaway below to win a subscription for your family!

Be sure to sign-up for their newsletter, because they send out great financial literacy resources to help you with teaching kids about money!

Show them

As we all know, kids repeat behavior exhibited by their parents, as well as, their stress surrounding it.

You don’t necessarily have to hide money struggles from your children, moments like these are wonderful lessons, but the way you speak about money will change how they view it.

If you find a way to feel abundant even in the more difficult moments, your child will take that with them too!

Have them volunteer

Volunteering is not only good for the soul but teaches the value of perspective.

Remind your kids that they might not have everything they want, but they have what they need and how important it is to remember that.

Plus, helping your community always rewards you in the end.

Hopefully, they will leave the experience more grateful for their possessions and more mindful of how they use their money.

Donating to charities is also a great way to teach them about giving back!

Savings goals

Create savings goals with your kids.

What would they like to save up for?

How much will they need?

How will they make money and how long might it take to earn it all?

(Playing the MoneyTime Financial Literacy Program game has helped my kids a ton in understanding this!)

Set up a bank account and let them start to save. Whether it’s from chores or an actual job, have them invest in themselves.

As they see that number grow and see their hard work pay off, they will naturally develop a greater appreciation for money – and hard work!

Needs vs. Wants.

Have your kid write down all of the things they need and all of the things they want (it would be good to see what they label as needs vs. wants.)

Set a budget for them to work with and have them research prices on each of the items listed.

Let your child write out what they would buy and why they found it important.

It’s a great way to segue into a discussion on priorities, responsibilities, growing up, etc.

Investing Pennies Still Adds up!

There’s no time like the present to start working on financial literacy skills.

These are lifelong lessons that we never stop learning (myself included!).

You can help your children get ahead of the game and maybe even learn more about your own habits in the process!

Talk with your kids about the value of saving money, let them get real-life experience, teach them through games like MoneyTime, and make money talks open and honest so they can take control of their financial futures!